How to Request a Copy of Your W-2 Form from Your Employer

As the tax season approaches, the significance of the W-2 form, commonly known as the Wage and Tax Statement, cannot be overstated. This crucial document provides essential details about an individual’s annual income and tax withholdings. However, there are instances where employees might encounter delays or misplacement of their W-2 forms. In this comprehensive guide, we’ll explore the steps to request a copy of your W-2 form from your employer, ensuring a smooth tax filing process without unnecessary stress or complications.

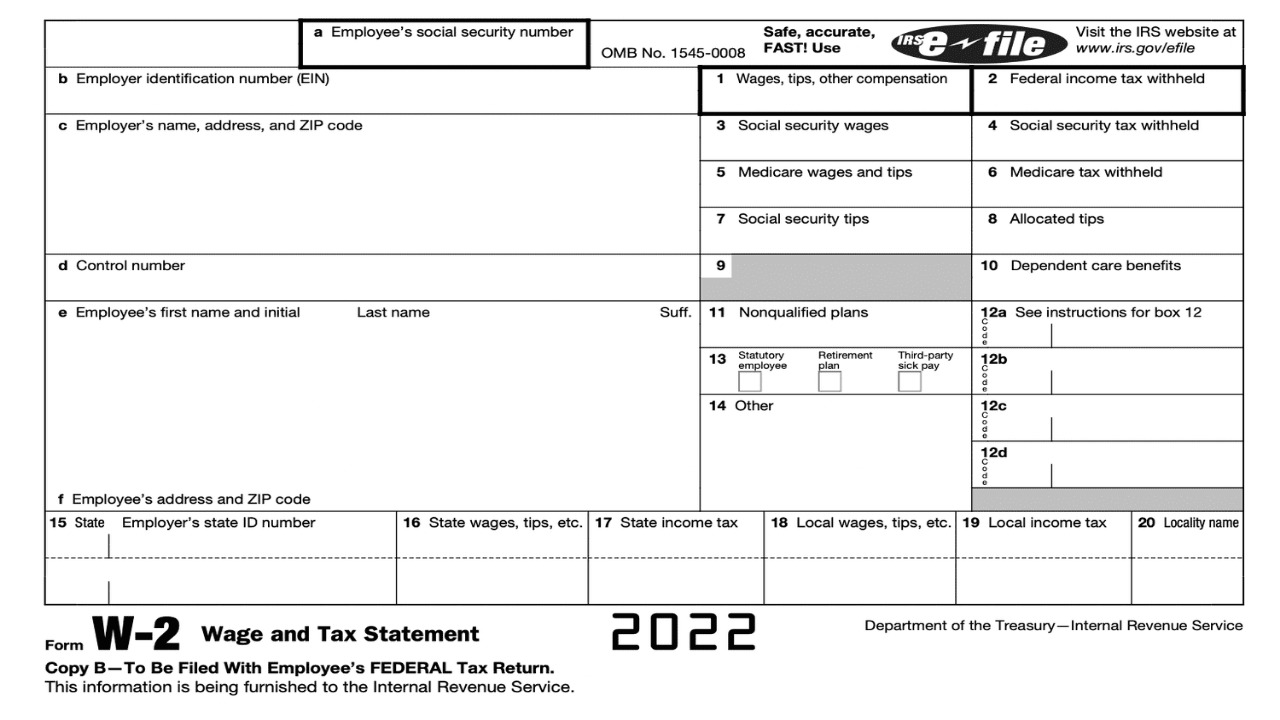

The Importance of the W-2 Form

The W-2 form is more than just another piece of paperwork—it serves as the cornerstone for accurate tax reporting. It provides a comprehensive summary of an employee’s earnings, including wages, salaries, tips, bonuses, and other taxable compensation. Additionally, it discloses vital information about the taxes withheld, such as federal income tax, state income tax, Social Security tax, and Medicare tax. In this article, you will learn what you need to do to request a copy of your W-2 form and things you need to be prepared for.

And if you are looking for a reliable and easy-to-use W-2 form generator, you can check it out here.

Check Your Communication Channels

Before initiating a formal request, conduct a thorough review of your communication channels. Employers often distribute W-2 forms physically via mail or electronically through secure online portals. Check your mailbox and your employer’s designated platform for payroll and tax information. In this digital age, employees are increasingly receiving W-2 forms via email or HR platforms.

Stay Mindful of the Deadline

By law, employers are obligated to furnish W-2 forms to their employees no later than January 31st of each year. However, it’s prudent to be patient and allow sufficient time for postal delivery, particularly if you have recently moved or updated your address. If your W-2 form hasn’t arrived by early February, it’s time to take the next steps.

Initiating the Request

When your W-2 form is nowhere to be found, it’s time to reach out to your employer’s payroll or human resources department. Courteously inform them that you have yet to receive your W-2 form or if it has been lost, and kindly request a replacement. Provide them with your updated contact details to ensure seamless communication.

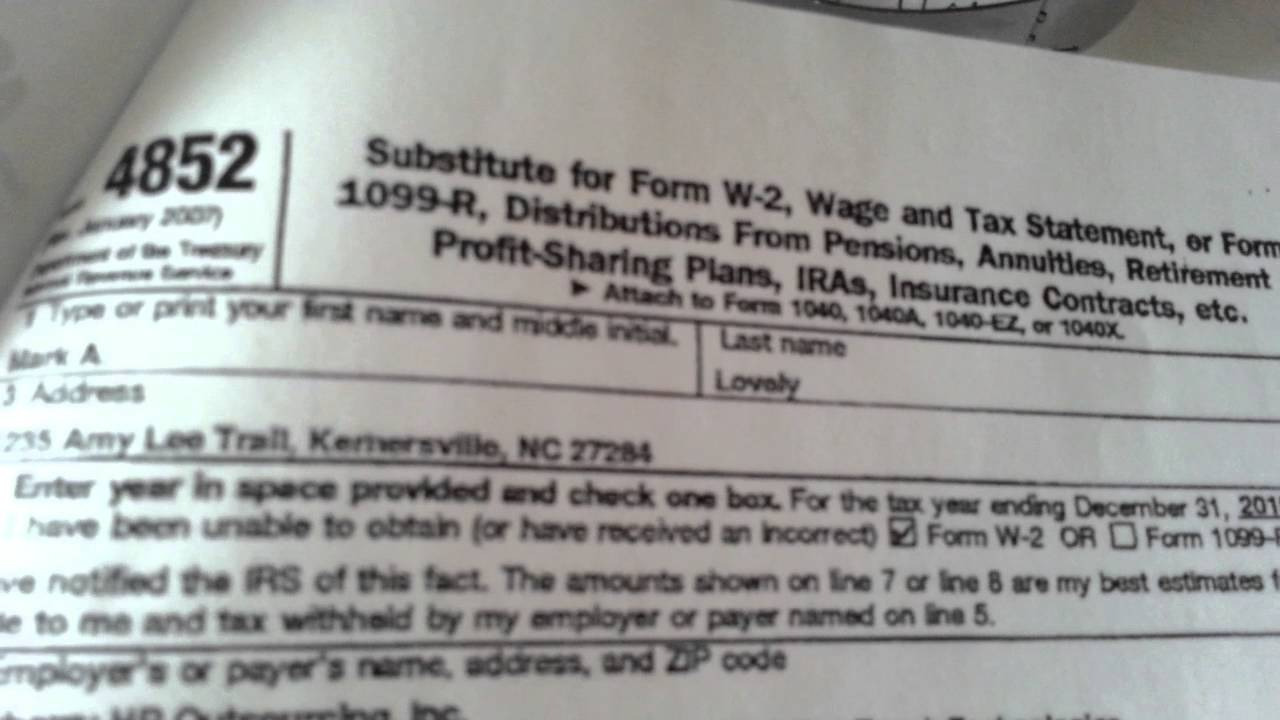

Be Prepared to Fill IRS Form

If your employer fails to provide a W-2 form or is further delayed, you can take proactive measures by completing IRS Form 4852, also known as the Substitute for Form W-2, Wage, and Tax Statement. This form allows you to provide an estimate of your wages and taxes withheld based on your personal records.

Key Information for IRS Form 4852

To effectively complete IRS Form 4852, you will need the following information:

Personal Details: This includes your full name, current address, Social Security number, and any other relevant identification information.

Employment Information: Provide your employer’s name, address, and employer identification number (EIN). You can often find this information on previous W-2 forms or your final pay stub.

Income Estimations: Estimate your wages, salaries, and tips earned throughout the tax year. Additionally, calculate any taxes withheld from your earnings to the best of your ability.

Filing Taxes with Form 4852

After completing IRS Form 4852, you can use it to file your federal income tax return. However, it’s important to note that using a substitute form might lead to processing delays. The IRS may need to verify the information provided before finalizing your tax return. Should you receive your official W-2 form after filing with Form 4852, compare the information. If discrepancies arise, consider filing an amended tax return.

Seeking Assistance from the IRS

In extraordinary circumstances where all efforts to obtain your W-2 form prove futile, don’t hesitate to seek assistance from the IRS. Reach out to them to explain your situation. The IRS can intervene by contacting your employer to ensure the timely issuance of your W-2 form.

Conclusion

As the tax season unfolds, the W-2 form becomes indispensable for accurate tax reporting. Ensure you stay proactive and initiate the process to obtain your W-2 form if it hasn’t reached you by the specified deadline. Check various communication channels, communicate with your employer, and be prepared to complete IRS Form 4852 if necessary. By following these steps, you can meet your tax obligations seamlessly, facilitating a smooth and stress-free tax filing experience.

Comments are Disabled